The new social security contribution system for self-employed workers In accordance with the Royal decree-Law 13/2022, published on the 26 th July, the new contribution system for self-employed workers is now a reality.

For the first time, self-employed professionals will pay social security based on their net monthly income, that is, the difference between their income and their expenses. For the purposes of determining your contribution base, the totality of net income obtained during each calendar year will be taken into account.

As of 2023, self-employed workers must choose the corresponding monthly contribution base based on their forecast of the monthly average of annual net income; these bases will be provisional and will then be regulated in accordance with their actual profits obtained, which will be communicated by the corresponding tax authorities.

The new contribution system for the self-employed entered into force on the 1 st January 2023 and will have a transitory period of nine years, until 2032.

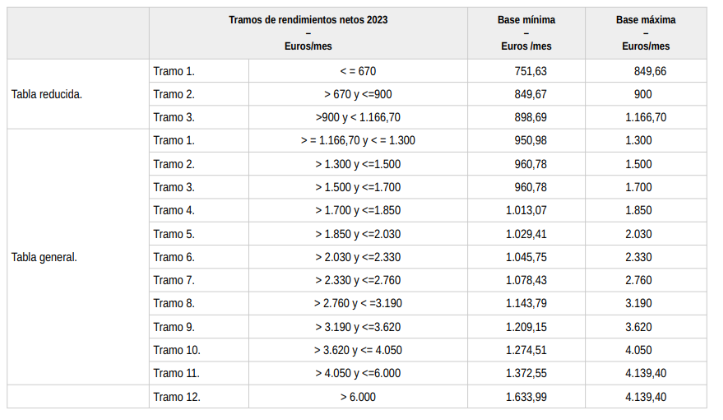

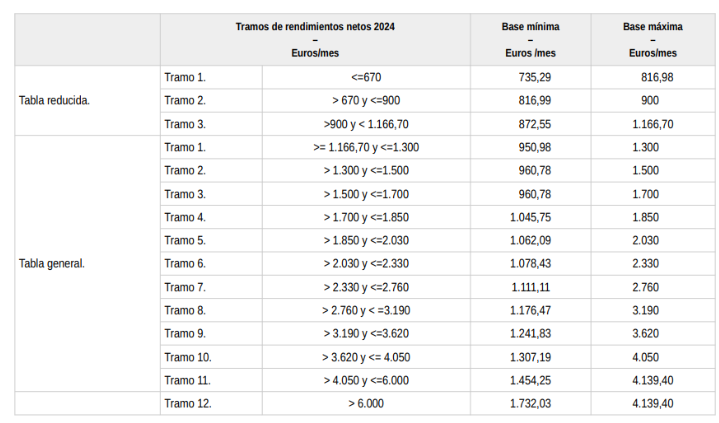

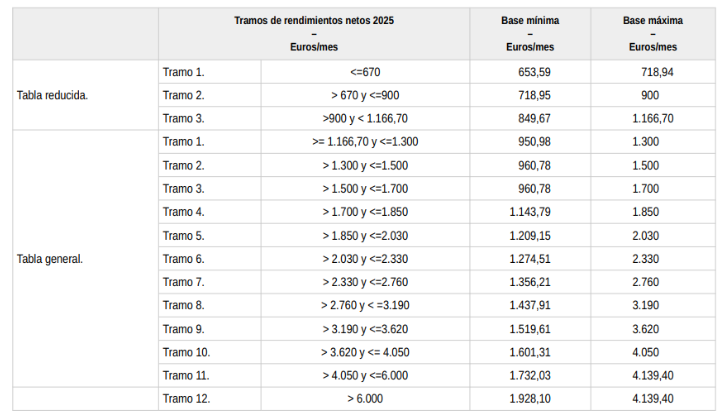

So far, 15 contribution brackets are set for the years 2023, 2024 and 2025. The following tables detail the minimum and maximum bases in accordance with the net income obtained.

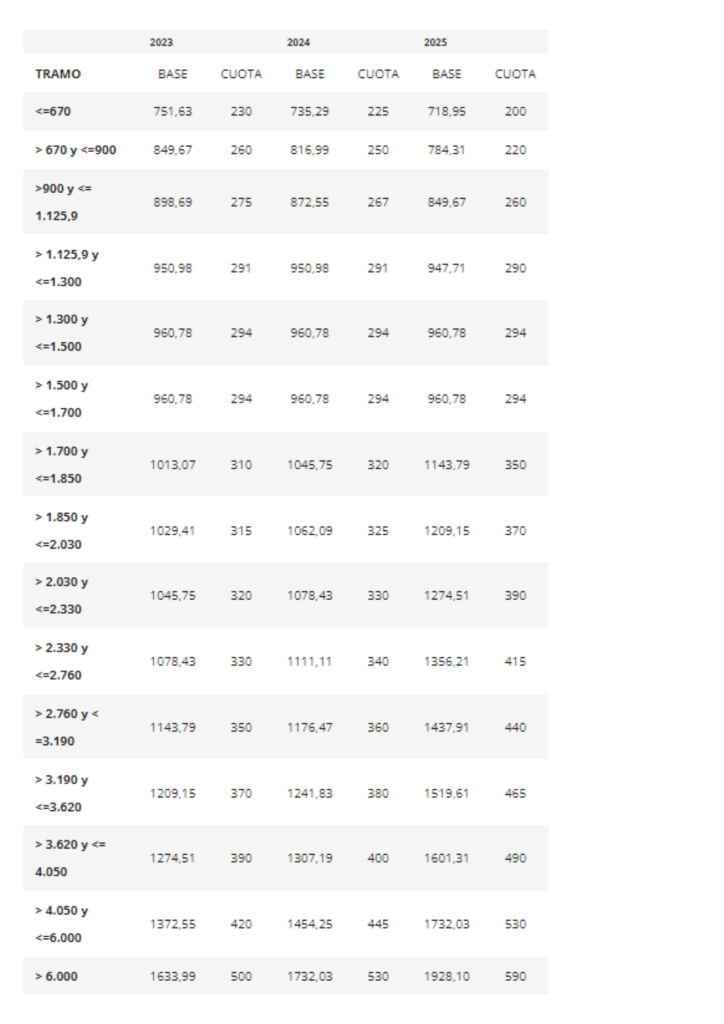

For example, in the year 2023, the social security for a self-employed person whose net income is in the lowest bracket will be 230 euros; in the year 2024 it will be reduced to 225 euros and in 2025, to 200 euros. While in the higher yield brackets the opposite happens, that is, the amount will increase over the next three years. Once this three-year period has passed, new tables will need to be agreed and published.

The table below shows the social security payments to be made in accordance with the net income obtained.

The flat rate stipulated in what’s known as the “Tarifa Plana” for newly registered self employed persons continues to exist, although with new features and with a different name (“Tarifa Reducida”). This amount will be 80 euros per month (between 2023 and 2025) and will last for twelve months, after which it will only be extended for those who have not managed to obtain returns equal to or greater than the SMI (interprofessional minimum wage).

If you are looking for integral advice, EBF Consulting is the best firm to resolve all your business matters. We are a digitalized company with offices in Madrid and the Canary Islands and a team of professionals to attend to all your needs wherever you are. Please contact us at admin@ebfconsulting.com